- LittleLaw

- Posts

- 🌱 How Gowling helped secure a multi-million pound renewables exit

🌱 How Gowling helped secure a multi-million pound renewables exit

Together with

Table of Contents

If you take just one thing from this email...

Gowling WLG’s lawyers helped split Island Green Power into two parts — UK projects (sold to Macquarie) and international projects (retained by the founders).

This kind of legal work is about more than paperwork: it’s about structuring a deal so both sides know what they own, what risks they carry, and how future projects will be handled.

EDITOR’S RAMBLE 🗣

Without this first ‘yes’, LittleLaw wouldn’t be here today.

And I wasn’t exactly an obvious bet.

Back in 2023 (while I was still working as a corporate lawyer) I’d squeeze calls to law firm recruitment teams in my breaks to see if they’d want to work with me.

I had this idea that LittleLaw could partner with law firms to share stories about their work, with insights from the lawyers involved.

But I had no track record. I didn’t even have a company email address (I sent my first law firm proposal from my Gmail).

Naturally, most law firms said no (I would have said no to me too).

But Gowling WLG said yes. They took a chance when no one else had.

That moment of trust changed everything. It gave LittleLaw the chance to work with a well-respected firm.

And that opened the door to all the other firms we’ve been lucky enough to partner with since.

So I’m really proud to say we’re working with Gowling WLG again this year. They’ve backed us from the very start.

For this week’s newsletter, we spoke to their lawyers about a super interesting green energy deal they advised on — and broke it down for you in detail.

I’d love to know what you think of it — use the poll below to share your views.

🤔 Did this week’s Gowling deep dive help you better understand what commercial lawyers actually do on deals?Give a reason after you vote |

– Idin

FEATURED REPORT 📰

🌱 How Gowling helped secure a multi-million pound renewables exit

What’s going on here?

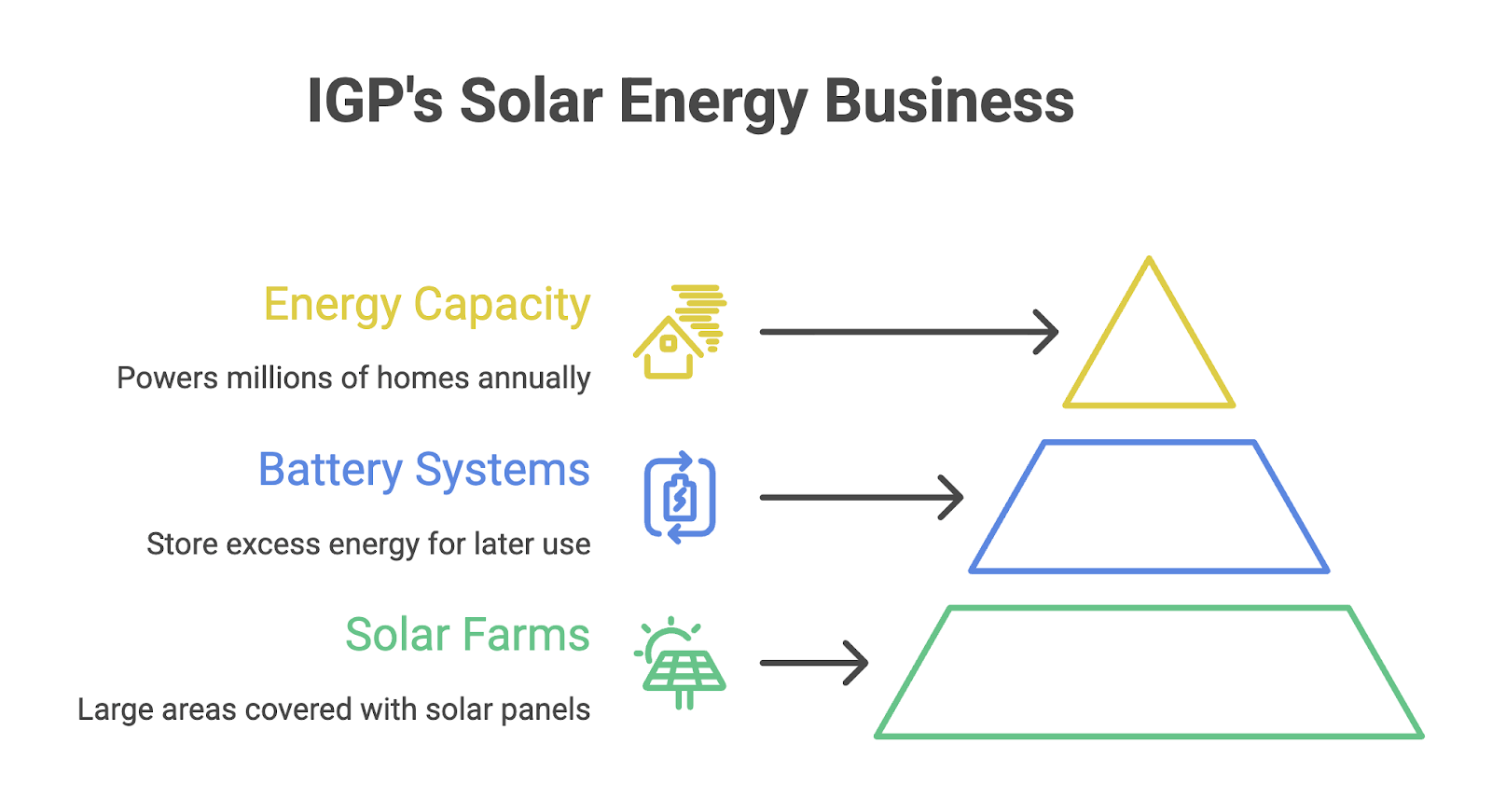

Island Green Power (IGP), a company that develops large solar and battery projects, has sold the remaining 50% of its UK business to Macquarie, a global investment firm.

The deal was led by Gowling WLG, who advised IGP’s founders through the process. It follows on from an earlier transaction in 2022, when Macquarie first bought 50% of the company (Gowling advised on that too).

Following this deal, Macquarie now owns the whole of IGP’s UK operations.

What does IGP do?

IGP develops large solar farms in the UK and internationally. A solar farm is a huge area of land covered with solar panels that generate clean electricity on a large scale.

Credit: Islandgp.com

They often pair these farms with battery systems. The batteries store excess energy made during sunny periods and release it when demand is high or when the sun isn’t shining (which makes it more reliable).

Together, these projects add up to more than 3 gigawatts of capacity — enough to power millions of homes each year.

IGP has also won planning permission for two of the biggest solar farms ever approved in the UK — Cottam and West Burton. They’re both classed as NSIPs. Keep those names in mind — we’ll come back to them later.

🤔 What’s an NSIP?

Nationally Significant Infrastructure Projects (or NSIPs) are very large projects — like power plants, airports, or, well, solar farms — that go through a special approval process run by the UK government instead of the local council.

In England and Wales, solar farms over 50 megawatts count as NSIPs. Anything smaller is decided by the local council instead (the rules are slightly different for battery projects, since they use less land).

For developers, NSIP status means bigger opportunities, but also more complex rules, more planning, and more paperwork to get right.

Why did Macquarie want to buy IGP?

Macquarie is a global investment firm based in Australia. It manages money for clients around the world.

So why does an investment firm want to buy a solar development company?

Because of how value is created.

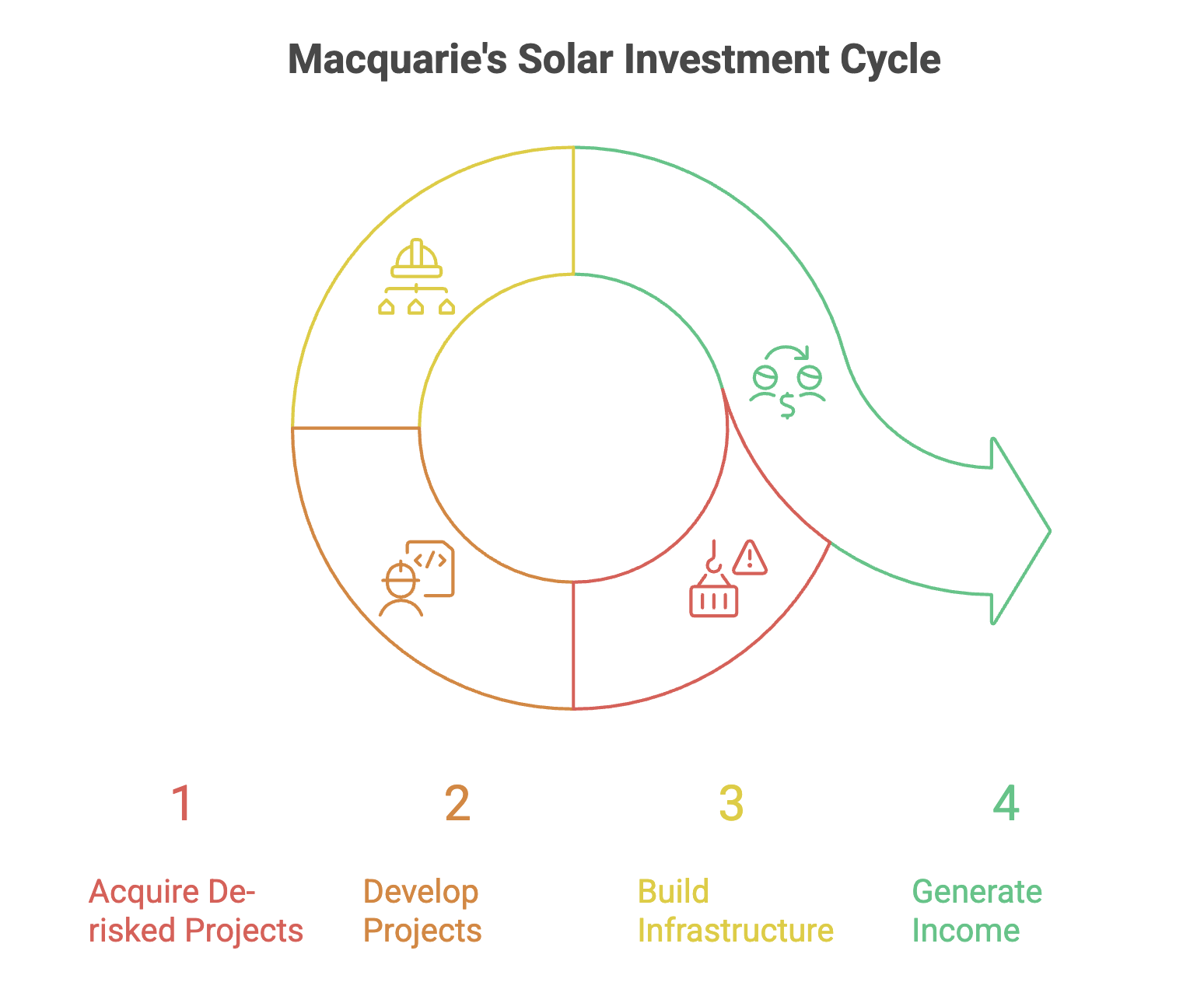

IGP is great at the earliest stage of development — securing land, planning permission, and grid connections. Throughout these stages, projects are still risky.

But once a project reaches the “ready-to-build” stage, the risk falls. Construction costs can be calculated, risks are clearer, and the chances of success are much higher.

Macquarie has the money to build and run these projects. When the solar farms and batteries go live, they sell power to the grid or to energy suppliers. That creates stable, long-term income for Macquarie and its investors.

Why did Macquarie want to buy IGP?

Gowling WLG advised IGP’s founders on the sale of their UK business to Macquarie.

Because the firm had already advised IGP in 2022, when Macquarie first acquired 50%, the lawyers knew the company, the market, and the client well.

That meant they were brought in early, and could get up to speed fast.

The main issue they dealt with was structuring the transaction — we’ll cover that below.

How was the deal structured?

See, this deal wasn’t as simple as Macquarie just buying IGP. The founders of IGP kept full ownership of the company’s international projects, while selling the UK business.

That meant the company group structure had to be split:

On one side would be the UK assets that Macquarie would own.

On the other side would be the overseas projects that the founders would continue to run.

Making this clean break wasn’t legally straightforward. Many parts of the business were shared.

For example, it’s typical for a contract to cover more than one group company. An IT services agreement, for instance, might apply to both the UK and international arms of the business.

Also, money may have moved between group companies. One entity might have borrowed from another, and those debts would have to be dealt with before the sale goes through.

So, how did Gowling WLG’s lawyers help get this cleaned up?

🗂️ Carve-out drafting: The lawyers prepared the sale documents so that UK assets and liabilities moved across to Macquarie, while international projects remained with the founders.

🔀 Allocating liabilities: Lawyers sort out the financial and legal links inside the group. For example, if part of the business being sold owed money to another group company that wasn’t part of the sale, that debt had to be repaid or transferred first. Otherwise, a buyer could end up owing money to a company it didn’t even own after the deal.

🌞 Future pipeline: The buyer’s lawyers would ensure that the UK arm being acquired included the big upcoming projects (such as Cottam and West Burton). Lawyers would also need to confirm that the UK business being purchased had the planning permissions, grid connection agreements, and land option agreements for those sites.

⚖️ Risk allocation: The deal terms would have to reflect Macquarie moving from being a joint owner to a sole owner. Lawyers would typically need to negotiate the warranties, any indemnities, and liability caps so that a founder could fully exit without open-ended risk. For example, lawyers can negotiate caps to the founders’ liability after the sale, so their exposure was limited if, for example, an unexpected tax issue later arose.

🤔 The role of trainees in this deal: Gowling WLG trainees had a hands-on role from the start of the transaction.

Here’s what they did:

→ Managed the transaction timetable and tracked the progress of the documents.

→ Drafted supporting documents like board minutes and resolutions.

→ Coordinated the signing process to make sure everything was executed correctly.

Were there other factors to consider?

Yes, there were some external factors that became a key part of this transaction.

For example, the UK government’s Clean Power 2030 plan was published while the deal was underway. That plan set out new targets and policies for scaling up renewable energy, creating both opportunities and risks for future projects.

For the lawyers, this meant thinking carefully about how the plan might affect IGP’s two largest sites, Cottam and West Burton. For example, would the new policies change approval timelines or add conditions that could affect project value? That could impact the commercial terms of the deal.

💡 Sharing in future upside: If a project grows in value after the sale, the seller can still get a slice of that upside. This is often done through things like deferred payments (where part of the price is paid later) or earn-out structures (where extra payments are made if the business performs well after the sale).

That was part of this deal too.

It also meant looking at how the deal documents handled risk. What if future rules made projects more expensive or slower to deliver — should that fall on the sellers or the buyer? Gowling WLG helped negotiate their client’s position on these.

In real-life transactions, external policy shifts aren’t just “background context.” They directly shape how lawyers draft documents, allocate risk, and protect value for their clients.

In this case, Gowling’s careful structuring meant IGP’s founders kept their international business, plus Macquarie got a UK business it could run from day one.

TOGETHER WITH GOWLING WLG* 🤝

Want to see behind the scenes of a top law firm?

Gowling WLG's new Sector Series is your chance to find out.

Here’s what you’ll find inside:

🗣️ Real talk from trainees and sector leaders in Real Estate, Energy, ESG & more

🎯 What makes Gowling WLG different (and how you can stand out)

🧑💻 Application tips direct from the Early Talent team

Whether you’re aiming for Gowling WLG or just want sharper commercial awareness, this is a chance to learn from the people shaping the legal world.

🎓 Applications open: Today (direct TCs and Vac Schemes)

🗓 Deadline: Wednesday 19 November 2025

P.S. Tomorrow (11am) you can hear directly from Gowling’s Early Talent team on how to ace your application.

* This is sponsored content

IN OTHER NEWS 🗞

😬 Over 230 SQE students got a shock when Kaplan mistakenly emailed them saying their October exam slots were cancelled. The emails landed after the helpline shut, leaving students panicked. Kaplan has since admitted it was an “erroneous system-generated message” and confirmed all bookings are safe.

⚖️ The Advertising Standards Authority (the UK’s advertising regulator) has banned “no win, no fee” adverts from three law firms. It found that they misled consumers about fees and compensation, and hid key costs or overstated payouts. The regulator said clients weren’t clearly told they were signing binding contracts or how much fees could be.

🚗 A cyber attack forced Jaguar Land Rover to shut all its UK factories in early September. The company now plans a phased restart, beginning with its Wolverhampton engine plant (starting next Monday) with other sites to follow. The stoppage has hit suppliers hard, so the government has stepped in with £1.5 billion in loan guarantees to support JLR and protect jobs across its supply chain.

AROUND THE WEB 🌐

🔤 Fun: A word game where you delete letters to create new words

🎬 Watch: This site is ChatGPT but for picking the perfect movie

📈 Cool: A free tool to see what past investments in stocks, crypto or ETFs would be worth today

STUFF THAT MIGHT HELP YOU 👌

📹️ Free application help: If you're applying to commercial law firms, check out my YouTube channel for actionable tips and an insight into the lifestyle of a commercial lawyer in London.

How did you find today's newsletter? |