- LittleLaw

- Posts

- 🧀 How cheese tanked a $46 billion merger

🧀 How cheese tanked a $46 billion merger

Table of Contents

If you take just one thing from this email...

The (failed) merger between Kraft and Heinz is a warning that bigger isn’t always better.

The two food companies merged in 2015, but it’s not been successful. That’s because they stopped innovating, ignored changing consumer tastes, and the two companies didn’t work well together.

The lesson? Mergers don’t always go well — if they’re done wrong, they can quickly destroy billions in value.

Lawyers play a big role when companies break up. They draft separation agreements, divide intellectual property, and make sure both companies can operate smoothly after the split.

EDITOR’S RAMBLE 🗣

The question I get asked at least once a week: “Can I work for LittleLaw?”.

Now, I love that — it means people see the value in what we’re doing, and want to be a part of it.

And finally the answer is — YES, because we’re hiring!

We’re working with more amazing law firms and external partners from this year (🥳). We’ll be running content campaigns to reach thousands of readers.

So, I’m looking to hire a Content Coordinator.

This will be someone to keep our content organised and polished. They’ll help look after our partners as we grow.

This is a paid, part-time, remote role (UK-based).

It’s a really interesting gig — it’ll let you work with people at your dream law firms, learning more about how they want to present themselves to potential candidates.

If you’re interested, click the link below to apply. As a LittleLaw reader, I’d love to see your application!

The deadline to apply is Monday 21 July 2025 — 10pm (UK time).

- Idin

FEATURED REPORT 📰

🧀 How cheese tanked a $46 billion merger

What’s going on here?

Kraft Heinz, the company behind the ketchup (and the other things below) plans to split into two companies: one for fast-growing sauces and another for food products like Mac & Cheese and frozen meals.

All the Kraft Heinz brands

Why is Kraft Heinz considering a breakup?

📉 The merger destroyed value: In 2015, Kraft and Heinz merged to create a food giant — the deal was valued at $46 billion.

But things went badly.

The two company cultures clashed — Kraft had a more traditional, brand‑focused culture, while Heinz pushed aggressive cost‑cutting and strict budgets. This made it harder to innovate and move quickly.

As a result, the company had six straight quarters of declining sales.

The company‘s now lost over 60% of its worth.

🧀 Customers want different food now: Kraft Heinz built its business on selling processed foods like Mac & Cheese and Oscar Mayer hot dogs. But consumers want healthier, fresher food now.

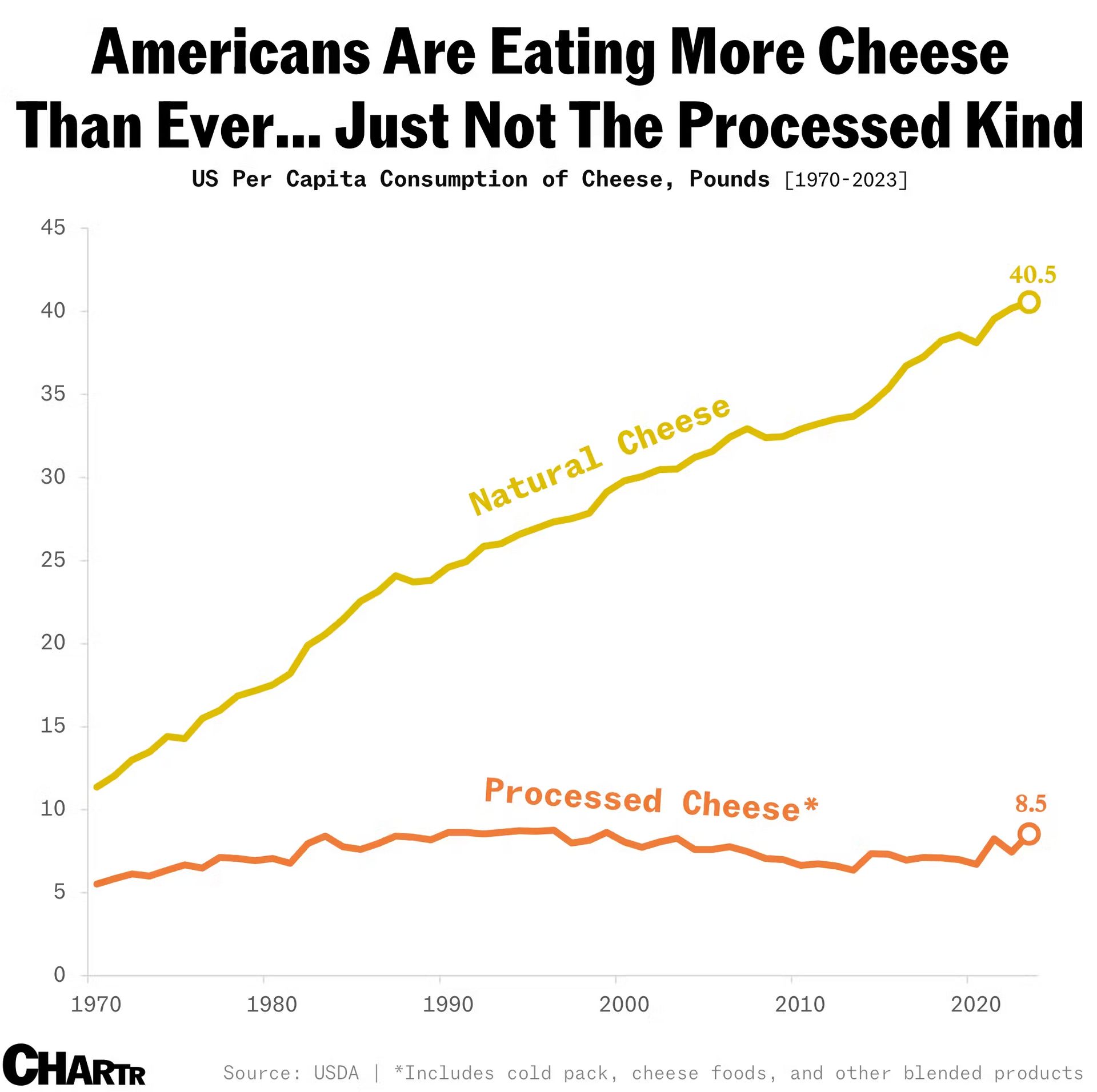

Natural cheese sales rose 3.6 times over 50 years. Processed cheese sales stayed flat. This shows in their results. Cheese and dairy dropped from 21% of their revenue in 2016 to just 14% in 2023.

🛒 Previous fixes didn't work: Kraft Heinz has tried to fix its problems in a few ways, but none worked.

It sold off smaller, lower-margin brands (like its Italian baby food brand) to focus on its “core strengths.” But these sales were too small to tackle the bigger problems the business faced.

Innovation stalled as the company kept cutting costs, leaving it with few fresh ideas while rivals grabbed the growing market for healthier, premium foods.

Kraft Heinz’s proud history of supplying processed cheese to soldiers and school lunches became a liability as those customers also moved towards less‑processed products.

Why is a breakup the answer?

📣 Shareholders are demanding action: Big shareholders want change. Berkshire Hathaway (Warren Buffett’s holding company) owns 27% of Kraft Heinz. Buffett admitted he "overpaid" for the original deal. Plus, in May, Berkshire even left the board of the company (this signals pressure for a major change).

🍅 Different parts perform differently: The sauce business is growing. Products like Heinz ketchup and Grey Poupon are doing well. But the grocery business is shrinking. Products like Mac & Cheese and frozen meals are struggling. Keeping them together holds back the good parts of the business from thriving.

💰️ Splitting could create more value: Breaking up might unlock hidden value. The sauce business could grow faster on its own. Then, the grocery business would be able to better focus on its own specific problems. Analysts think the grocery part alone could be worth $20 billion.

Is this part of a wider trend in the food industry?

Yes — Kraft Heinz’s breakup is part of a bigger shift in the packaged food sector. As consumers move towards fresher, healthier products, big companies are ditching underperforming, processed brands to focus on fewer, stronger ones.

Others, like Kellogg’s and Mondelez, have already spun off slower-growth units or sold non-core brands to stay competitive.

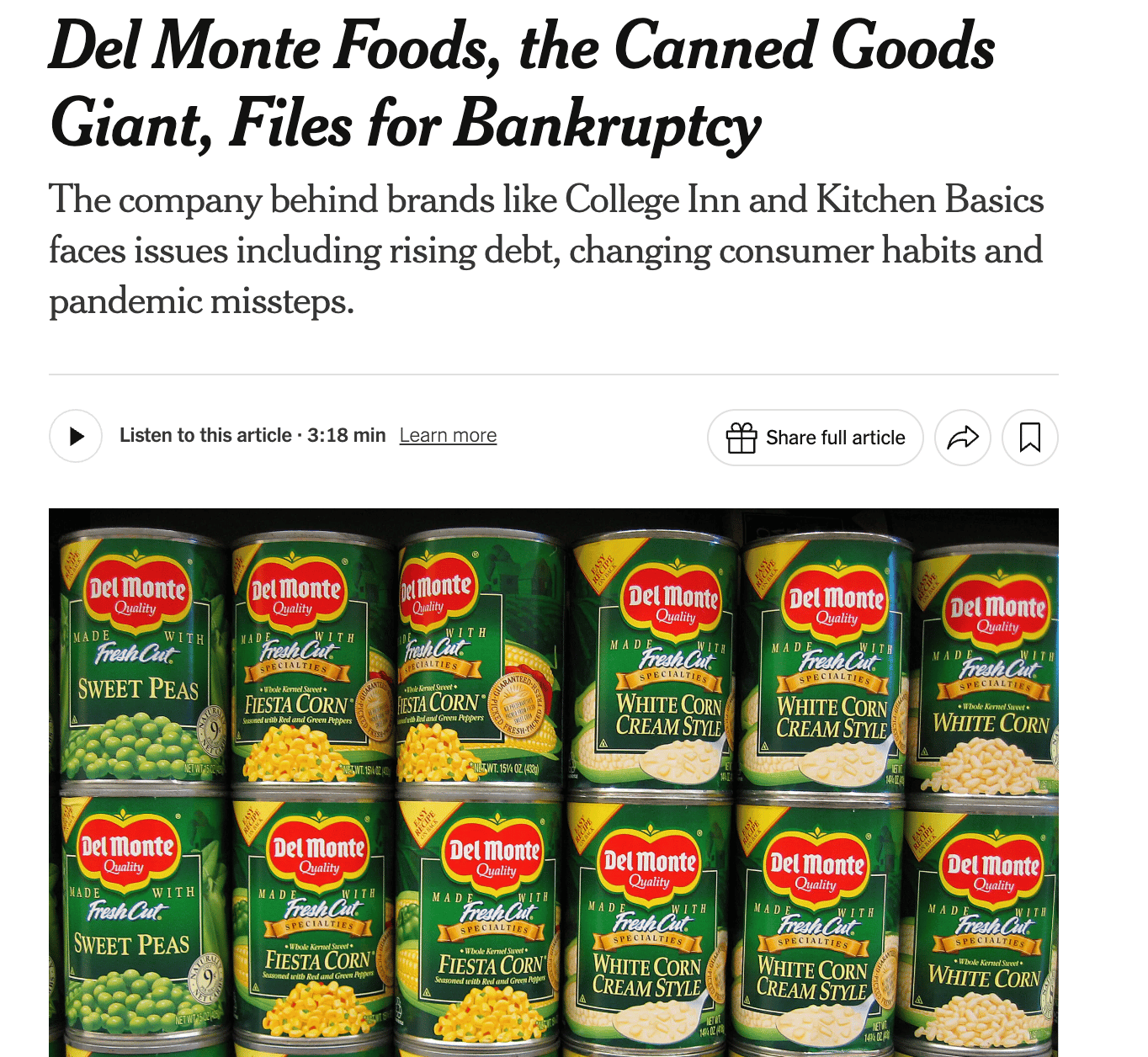

Del Monte, the canned goods company, went bankrupt under similar pressures.

With rising costs, changing tastes, and smaller rivals taking market share, the whole food industry is changing its strategy.

How can you use this in your applications?

If you reach an assessment centre, you’ll often be given a case study to work on. These case studies are usually based on a mergers and acquisitions (M&A) scenario.

At that stage, most candidates focus only on the benefits of merging, like:

bigger market share,

economies of scale,

growth, etc.

But Kraft Heinz is a perfect example of the risks of merging — and if you talk about these, you’ll really stand out.

That’s because, spotting and explaining these risks makes your answer much stronger and more realistic.

So, when you’re dealing with an M&A scenario, think: "What risks should I highlight to a client considering a merger?"

This table could help you out:

Risk | What it means | Example from Kraft Heinz |

|---|---|---|

Overestimated benefits | Savings or “synergies” often don’t materialise, or are offset by inefficiency | The merger was meant to create a more valuable business, but destroyed $14 billion in value |

Cultural clashes | Different styles and values lead to friction, bad decisions, and staff leaving | Kraft and Heinz never aligned culturally. Kraft had a more traditional, brand‑focused culture, while Heinz pushed aggressive cost‑cutting and strict budgets. This made it harder to innovate and move quickly. |

Legal & regulatory hurdles | Big mergers face need sign-off from competition regulators. Plus shareholder approvals can sometimes delay or block deals | As lawyers, you would have to be aware of these risks to make sure your client’s informed |

Shareholder pressure | Investors can force a breakup if results disappoint | Berkshire left the board to pressured management |

Bigger isn’t always better | Scale can make a company slow and unresponsive | Kraft Heinz became too big to adapt to changing consumer tastes (unlike its smaller competitors) |

💔 The role of lawyers when companies break up: Lawyers help untangle everything so both businesses can stand on their own.

They negotiate and draft the separation agreement, which decides who gets what — like brands, factories, debts etc.

They also deal with issues like dividing up trademarks and intellectual property, ensuring both businesses can keep using their names and products without disputes.

On top of that, they set up transition arrangements — like shared services or licensing deals — so both sides can keep running while the split takes effect. These decisions shape the future of both companies and requires strong legal and business judgement.

IN OTHER NEWS 🗞

🍫 Ferrero, the maker of Nutella, is buying WK Kellogg (the cereal maker) for $3.1 billion. Last year, Kellogg Co. split into two companies: the snack business became Kellanova, and the cereal business became WK Kellogg. Ferrero wants to grow beyond chocolate and grab more of the US food market. It’s a tough moment though, as shoppers pick healthier and cheaper cereals (plus, cocoa prices have been rising). Still, Ferrero seems to think it’ll be a sweet bet. Davis Polk advised Ferrero, while Kirkland & Ellis advised WK Kellogg.

🚀 Bitcoin shot past $118,000 on Friday — a record high. The reason is that investors are betting on upcoming tax and regulatory changes to bring crypto mainstream (this week’s been labeled “Crypto Week” in the US). Investors put $1.2 billion into spot bitcoin ETFs on Thursday. These are funds that actually buy and hold bitcoin, so when people buy shares in the ETF, the fund buys more bitcoin. Basically, money flowing into these funds pushed up demand for bitcoin itself. This price change shows how government support boosts prices of cryptocurrencies.

🏢 Covington & Burling is moving to a four-day in-office week, including in its London office. Lawyers now come in Monday to Thursday and can work from home on Fridays. They also get up to two weeks of remote work in August, as long as they stay available. This follows other US firms like Skadden and Ropes & Gray, which want more office time to build culture, mentor juniors, and justify expensive offices. Reactions are mixed — some lawyers value flexibility, while others say being present helps learning and client service.

AROUND THE WEB 🌐

🧠 Fun: A simple memory game where you’re graded on time and accuracy

💰 Ouch: HMRC to slap Wimbledon winners Sinner and Swiatek with £1 million tax bill

🍸 Cheers: The most unique, must-visit bars in most cities around the world

STUFF THAT MIGHT HELP YOU 👌

📹️ Free application help: If you're applying to commercial law firms, check out my YouTube channel for actionable tips and an insight into the lifestyle of a commercial lawyer in London.

How did you find today's newsletter? |